What is an Internal Audit?

An internal audit is an independent, fair and unbiased process that helps a company improve by evaluating internal processes and providing recommendations that will mitigate risk and optimize operations.

Not only are internal audit services important for ensuring information security and regulatory compliance, but they are also a valuable way to evaluate company performance and manage risk. It is a helpful tool for businesses of all types. The definition of internal audit is an assessment that helps an organization in defining areas where it could improve, while also providing information it needs to accomplish its goals.

For company boards and management, an audit is a great time to reflect and ask the following questions:

- Are we making progress toward our compliance goals?

- Is risk being managed effectively? Are policies and procedures being applied correctly?

- Could they be improved?

These are just some of the questions that an internal audit can successfully answer. Now, let’s go through some of the main questions that organizations have about how internal audits work.

What Services Are Internal Auditors Responsible for?

Regular internal audit services ensure the company has the ability to survive in a competitive business environment, and continue to prosper. You may still be wondering how to conduct an internal audit; this is the process that auditors follow;

- Monitoring, analyzing and assessing the risks and controls of the organization

- Reviewing the organization’s compliance with state and federal policies and laws

- Making reassurances and recommendations to the organization or company’s owners or governing boards

Essentially, they gather information on how an organization or company is operating and uses it to show where it is doing well and where it can improve.

Objective outsourced or co-sourced audits, performed by professionals who have no personal connection to the organization, are an excellent business investment. Internal audits done often make sure the company is in compliance and that every department is working as efficiently, effectively, and securely as possible.

Related article: The Role of an Internal Auditor for Disaster Recovery Planning.

How Are Internal and External Audits Different?

Internal audits and external audits are quite different, both in terms of their objectives and procedures. The main difference is that internal audits are not regulated and can, therefore, be applied more flexibly. Internal audits may be used to highlight information that is helpful to a company seeking ways to increase information security, manage other risks more effectively and guarantee compliance.

These are some of the differences which demonstrate how an internal audit can be more effective than external audit:

| Internal Audits | External Audits | |

|---|---|---|

| Objective | The objective of an internal audit is to educate management and employees about how they can improve business operations and efficiency. | The objective of an external audit is to give reliability and credibility to the financial reports that go to shareholders. |

| Owed Responsibility | An auditor is a trusted consultant charged with advising upper management on how to best manage the company’s risks and goals. | External auditors have no responsibility to the organization other than determining the accuracy of annual financial statements. |

| Reports to | An auditor reports to those within an organization | An external auditor reports to shareholders who are outside the governing structure of an organization |

How to Conduct an Internal Audit

When an internal auditor comes into a company or organization, they analyze documents regarding the company’s risks, objectives and performance, as well as observe how particular strategies are being implemented.

They evaluate emerging technologies, analyze opportunities, examine global issues, assess risks, controls, ethics, quality, economy, and efficiency, and communicate information and opinions with clarity and accuracy.

Experts recommend relying on outsourced auditors as they can better view the company’s operations objectively and without the bias typical of actual employees.

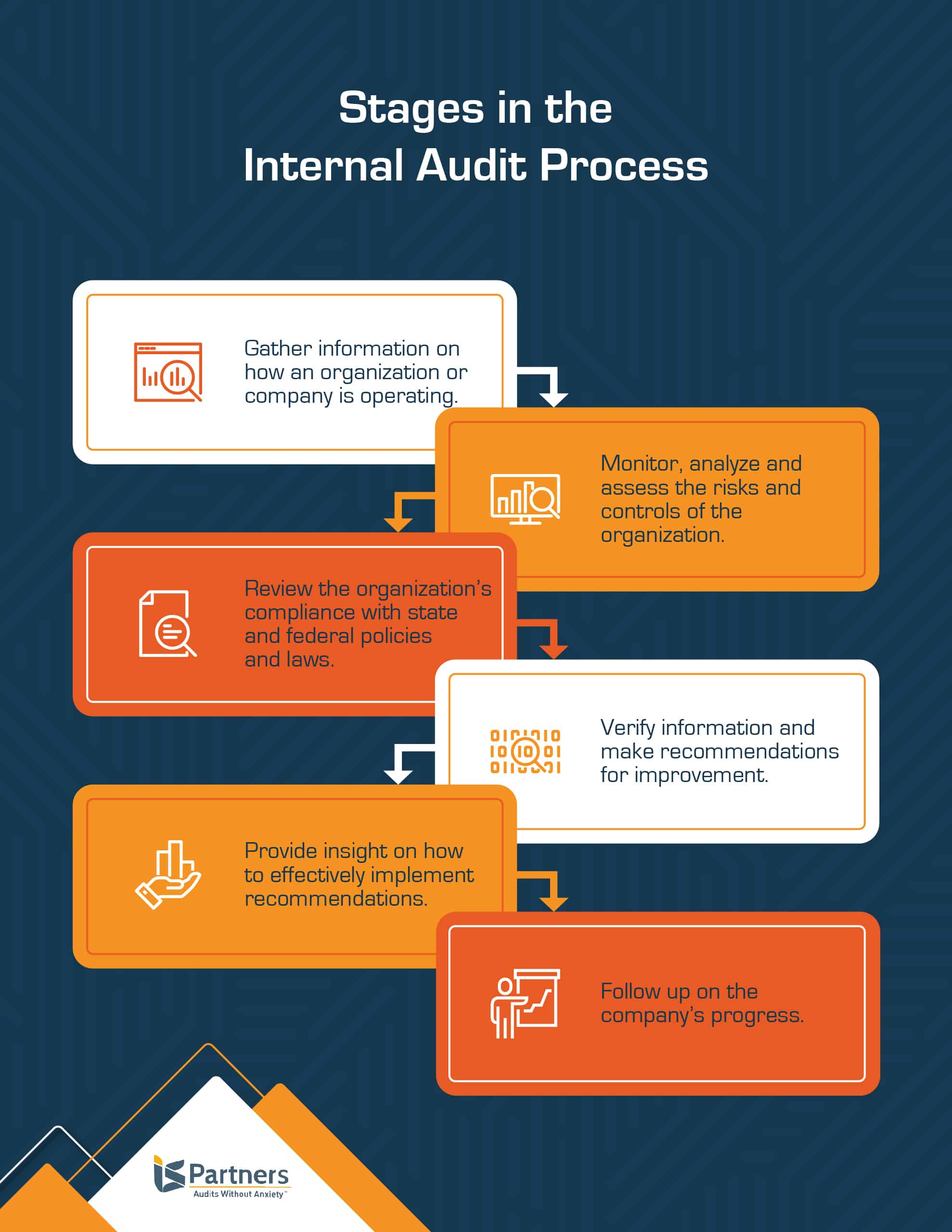

The internal audit function generally works like this:

- Information gathering – The auditor will observe, take notes, review documents and interview employees to better understand how the organization is operating.

- Security Assessment – Auditors will monitor analyze and assess the risks and security controls of the organization. At this stage, they will often test employees’ knowledge of company objectives, safety standards, and compliance rules.

- Compliance Assessment – The auditor will review the organization’s compliance with state and federal policies and laws, as well as any applicable international data security and privacy regulations.

- Verification – This is when the auditor checks the information provided and identifies points that could use improvement

- Consultation – Next, the auditor consults with the organization to provide recommendations for remediation and steps for implementation.

- Review – The audit doesn’t just end with the audit report; the auditor will also follow up with the organization to check on its progress and ensure continual improvement.

How Long Does an Internal Audit Take?

The time needed may take up to a few weeks, depending on the scope of the audit and the size of the company, or department, being assessed. Before it is concluded, an audit includes a consultation with the director or audit committee that hired them to discuss how their suggestions for improvement can best be implemented.

What is the Purpose of an Internal Audit?

Auditing on a periodic basis keeps a company – big or small – and all of its employees at the top of their game. Regular internal auditing services are important for organizations in a wide range of industries, including financial institutions and healthcare providers. They are positive experiences for the business aimed at evaluating performance and identifying actionable ways to improve in the future.

This should not be considered an intimidating process for employees because the auditor is not there to place blame. When staff is informed of upcoming audits and their scope, the process provides excellent insight that will help strengthen your company and help it dominate the market.

Related article: Why Should You Consider Outsourcing or Co-Sourcing Your Internal Audit Services?

Businesses who periodically bring in a third party auditor, like I.S. Partners, LLC, are shown to have better performance, risk management, regulatory compliance, management control and governance processes over time.

Is Your Company Operating at Peak Performance?

If you want to make sure your company or organization is meeting the highest standards in every area, including data compliance and security, trust a third party auditor like I.S. Partners, LLC. It is an excellent investment in your company’s future.

Regular auditing will ensure your company is always in compliance, operating efficiently and one step ahead of the competition. To schedule an initial consultation, call I.S. Partners, LLC at 215-675-1400 or internal audit quote.

This blog was originally published in May 2017 and has been updated for accuracy and comprehensiveness.