Key Takeaways

1. PCI DSS 4.0 Raises the Bar: Expanded scope, new control options, and stricter testing make compliance more complex.

2. Continuous Risk Management Is Essential: Treat compliance as an ongoing process, not an annual event.

3. Preparation Prevents Findings: Regular internal audits and expert guidance reduce costly last-minute issues.

As of March 2025, all organizations that store, process, or transmit cardholder data must fully comply with PCI DSS 4.0. This latest version of the Payment Card Industry Data Security Standard (PCI DSS) introduces new requirements designed to strengthen cybersecurity controls, improve flexibility, and address emerging payment technologies.

Yet, even experienced compliance teams are finding PCI DSS 4.0 to be more demanding than previous versions. The standard’s emphasis on continuous risk management, customized approaches, and expanded testing procedures has created new opportunities for oversight. It also introduces new pitfalls for organizations that aren’t fully prepared.

Below are six of the most common mistakes companies make when pursuing PCI DSS compliance, along with best practices to stay ahead of them.

1. Underestimating the Scope of PCI DSS 4.0

PCI DSS 4.0 expands the definition of systems in scope, now covering service providers, cloud environments, and connected systems that could affect cardholder data security, even indirectly. Many organizations still scope their environment too narrowly, missing third-party integrations or overlooked assets like virtual machines and APIs.

How to avoid it:

Perform a comprehensive data flow analysis and update your network diagrams to include all systems that store, process, or transmit cardholder data. Work with your qualified security assessor (QSA) to confirm your scope reflects your full technology ecosystem.Learn more about how the standard has evolved in our overview of PCI DSS versions.

2. Not Understanding the Targeted Risk Analysis (TRA)

PCI DSS v4.0 introduces Targeted Risk Analyses (TRAs) for specific requirements where the standard now allows flexibility. This includes defining your own control frequency or implementing a customized control. Instead of one broad annual risk assessment, PCI now expects focused, evidence-based justifications that explain why your chosen approach still manages risk effectively. These TRAs must be documented, reviewed annually, and updated whenever something material changes.

How to avoid it:

Working with a QSA helps because they know which controls require a TRA, what level of justification PCI expects, and how to align your decisions with the intent of the standard. A QSA can streamline the process, ensure consistency in your documentation, and reduce the risk of gaps that could cause assessment delays or noncompliance.

3. Neglecting Training and Awareness Programs

The human factor remains one of the largest sources of compliance failure. PCI DSS 4.0 strengthens requirements for security awareness and role-specific training. However, many organizations still rely on outdated, one-size-fits-all modules.

How to avoid it:

Deliver training that’s targeted to employee roles. Developers, administrators, and customer service teams all have different responsibilities under PCI DSS. Regularly refresh content to address new threats and policy changes.

4. Incomplete Testing and Validation Procedures

Testing frequency and rigor have increased under PCI DSS 4.0. Yet, organizations often fail to implement complete testing coverage across all required controls, especially in multi-cloud or hybrid environments.

How to avoid it:

Adopt a structured testing schedule that aligns with the PCI DSS 4.0 validation requirements. Include penetration testing, vulnerability scanning, and configuration reviews across all in-scope systems. Document all test results thoroughly for your next assessment.

5. Ignoring Dependencies Between Controls

Controls in PCI DSS 4.0 are interdependent. A failure in one area, such as weak access controls, can cascade into failures in related requirements. Many compliance teams still treat each control as an isolated task.

How to avoid it:

Map dependencies between controls and systems. For example, ensure identity and access management controls align with monitoring, logging, and segmentation. A control-relationship map can help you visualize and mitigate risks before they lead to audit findings.

6. Waiting Too Long to Prepare for Assessment

PCI DSS 4.0 demands more documentation, evidence, and validation than earlier versions. Organizations that begin preparing only a few weeks before their annual assessment often scramble to produce the required evidence, increasing stress, cost, and audit risk.

How to avoid it:

Maintain a continuous compliance model. Conduct internal mini-audits throughout the year and automate evidence collection wherever possible. Partnering with an experienced PCI DSS compliance advisor can help you stay audit-ready year-round.

Staying compliant with PCI DSS 4.0 requires more than checking boxes—it demands a holistic view of risk, technology, and evolving regulatory expectations.

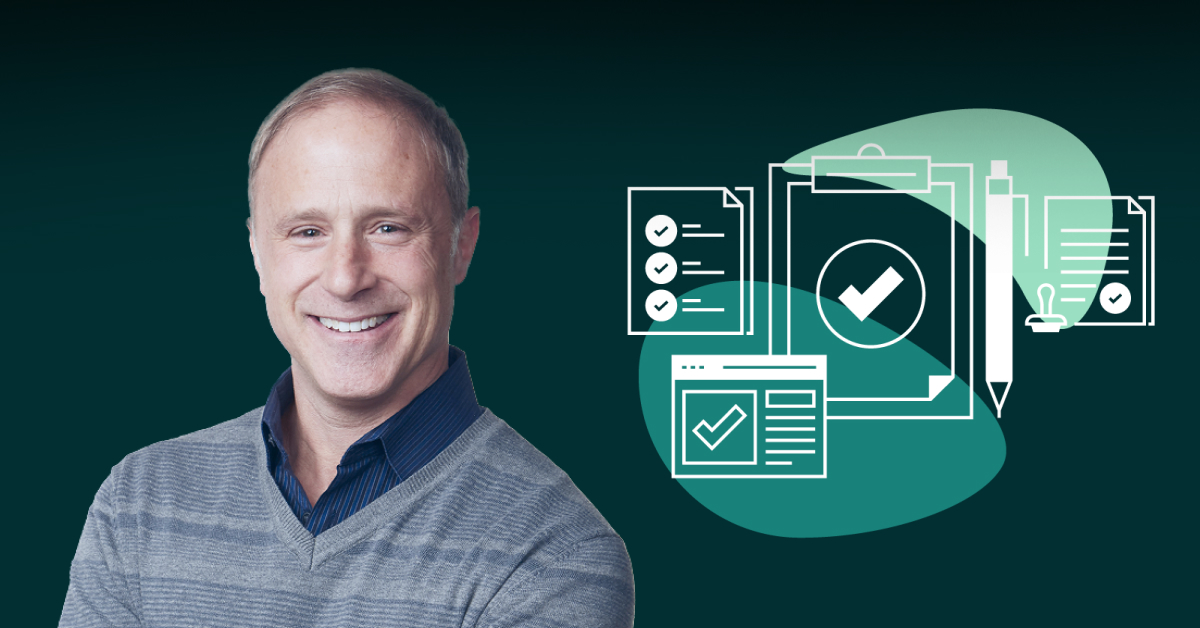

I.S. Partners helps organizations achieve and sustain PCI DSS compliance through a streamlined audit model that integrates testing, remediation, and readiness assessments. Our auditors and advisors specialize in simplifying complex frameworks, including SOC reporting, CMMC, and HITRUST, while staying ahead of emerging standards like AI-focused regulations, including the NIST AI Risk Management Framework (AI RMF) and the EU AI Act.

With tailored guidance and continuous readiness support, I.S. Partners helps reduce audit fatigue and ensures your team is prepared for whatever’s next in data security compliance.

Ready to strengthen your PCI DSS compliance program?

Learn more about I.S. Partners’ PCI DSS services

What Should You Do Next?

Assess your current posture: Perform a gap analysis against PCI DSS 4.0 to identify new control requirements.

Review documentation and evidence: Ensure all testing and validation activities are logged and traceable.

Engage a trusted compliance partner: Leverage expertise from I.S. Partners to streamline your PCI DSS compliance journey and stay ahead of evolving standards.